Contents

We’re also a community of traders that support each other on our daily trading journey. Using oscillators, like Stochastic or RSI, will help increase the odds of you finding a turning point in a range as they can identify potentially oversold and overbought conditions. In a choppy market, there is no clear direction, and the price just “chops around” or “chops up and down” and trades within a very narrow range. Likewise, the low price acts as a major support level in which price can’t seem to break as well. The high price acts as a major resistance level in which price can’t seem to break through. For example, if a stock is trading near its 52-week high, some investors might view that as a sign that the stock is nearing its peak and will soon fall.

Stop loss orders could be triggered by price swings and could result in an execution well below your trigger price. Using ATR in your trading practice, remember that it is not a directional indicator and measures only volatility. Moreover, the ATR is a subjective measure and it can’t be used as a standalone indicator, giving you some insights of whether the trend is about to reverse or not. Still, the ATR is a great tool, when it comes to adapting to ever-changing market environment. If you would like to know how to read the ATR indicator, watch a short video about using the Average True Range technical analysis method in your ATR indicator strategy. This Indicator uses Average True Range to determine a safe place to put stop losses to avoid being stop hunted or stopped out of a trade due to a tight stop loss.

Those looking to join the crowd will need to understand not just the types of range they’ll face but also the strategy behind using these ranges to full effect. After a company announces a strong earnings report, for example, investors might rush to buy that company’s stock, causing the stock to reach a high for, say, the month. Yet in the following days, after the earnings excitement dies down, demand might not be strong enough to support this high price, so the stock starts to trade a bit lower.

Support and Resistance

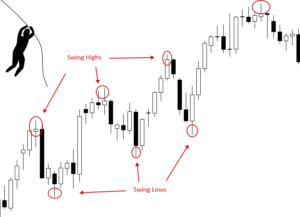

The upper and lower boundaries indicate that buyers and sellers are battling for control of the next trend. This will take place for a while before a new trend develops and it usually takes place after a breakout of a range happens. Usually it is quite easy to predict how prices are likely to move once the boundaries of a range are clearly established.

Notice that the major currency pairs (EUR/USD, GBP/USD, USD/JPY, AUD/USD, NZD/USD, and USD/CAD) tend to trend more. They do have periods of consolidation, but still are less suitable for range trading. Crosses (EUR/GBP, CHF/JPY, AUD/CAD, and GBP/JPY) spend more time in ranges. As mentioned above, a stock can be said to be in a range, volatile, or in a trend environment. In most cases, trading a trending asset is substantially better than trading one that is ranging. With a trending asset, you can easily buy low and sell high or sell high and exit low.

Trade the power move into resistance

Investors who intend to profit from range-bound trading go for instruments with lower volatility since higher volatility indicates turmoil in the market. A high price serves as a major resistance level in a range-bound market, which can be considered a ceiling for price action and cannot be broken. Pinpoint Entries and Exits –Successful hire drupal developer requires traders to pinpoint optimal price entry and exit points. Breakout trading strategies are also implemented in some ranging markets to take advantage of the emergence of new strong trends when high volatility returns. Range trading has a simple logic and can be mastered even by beginner traders. At the same time, it’s necessary to remember that while in range the market is in the situation of uncertainty.

When the price is at or near support levels, the principle is to look for opportunities to place buy orders. When buy orders are placed, resistance levels serve as optimal price target areas. The straight lines represent the trading range and provide the trader with the support and resistance zones needed to provide entry points and areas for stop losses and limit orders. Simply put, a stock experiencing a high level of volatility has a higher ATR, and a stock with a lower volatility has a lower ATR. Traders may use the indicator to enter and exit trades and to put a stop loss and take profit orders. The Average True Range trading strategy can be of great help when it comes to making trading decisions.

For example, a stock is trading at $35 and you believe it is going to rise to $40, then trade in a range between $35 and $40 over the next several weeks. You might attempt to range trade it by purchasing the stock at $35, then selling if it rises to $40. You’d repeat this process until you think the stock will no longer trade in this range. The Average True Range is one of the most popular and widely-used technical analysis indicators, it tracks the volatility of a particular market. Unlike numerous other technical indicators, the ATR does not indicate the market’s price trend, measuring only the degree of its volatility. Whereas range trading usually takes place over relatively short timeframes, trend following takes advantage of the patterns that have formed over longer timeframes.

Factors such as height, length, and trading volume at a specific zone determine the strength of support and resistance of regions. Therefore, a security in a range-bound market can either be bought when the price approaches a support level or be sold when the price reaches a resistance level. Traders can avoid false bounces or breaks by adopting various methods, such as trade filters or trade triggers, to enter a trading range. There are various range-bound trading strategies, including key technical tools such as Bollinger Bands, oscillators, and moving averages, among others. A trading range is the vertical price movements between a resistant ceiling and a support floor for a period of time.

What Determines a Trading Range? 🤔

You could try and range trade it by buying oil at $65, then selling it if it goes higher to $70. You would repeat this process until you think oil will no longer trade in this range. Chances are, the market needs to breathe after moving so fast in a short period of time. However, identifying a range-bound market and its breakout point can be a bit tricky. Even with experience, markets don’t always behave the way you think you will. It can also take quite a bit of time to find markets that work well for this kind of trading.

- Next, purchase the cryptocurrency at its support line, and sell it at its resistance line.

- Range trading is straightforward- you need to buy at support and sell at resistance.

- A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance.

- Find out how you can pick tops and bottoms in both trending and ranging market environments.

Technical analysis focuses on market action — specifically, volume and price. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with. https://traderevolution.net/ is an active investing strategy that identifies a range at which the investor buys and sells at over a short period.

Live Trading with DTTW™ on YouTube

Bollinger bands are very popular among traders because they give you information about the changes in volatility, as well as the stable range of a price. Bollinger bands express a price’s moving average as well as their fluctuations. To create the bands, the software takes the standard deviation of price-data changes over the time period, and then adds and subtracts them from the average closing price . The moving average shows the average price of a security during a given period.

Therefore, they would set their stop loss orders further away to avoid being kicked out of the trade prematurely. Vice versa, when the ATR indicates lower volatility, traders may use a closer stop loss. The ATR indicator represents an N-period smoothed moving average of the true range values. A trading range which is formed during the first three trading day of any month sets an important “Month Opening Range”.

Range Trading Strategies

For instance, there should be a significant increase in volume on the initial breakout or breakdown as well as several closes outside the trading range. Instead of chasing the price, traders may want to wait for a retracement before entering a trade. For example, a buy limit order could be placed just above the top of the trading range, which now acts as a support level. A stop-loss order could sit at the opposite side of the trading range to protect against a failed breakout. Traders can enter in the direction of a breakout or breakdown from a trading range. To confirm the move is valid, traders should use other indicators, such as volume and price action.

Once you have found good market conditions for range trading, you will want to purchase near the resistance line and sell near the support line. Many traders appreciate that range trading offers very clear entry and exit points for their trades. If you want to do research, indicators for forex, stocks, and other financial markets can be helpful tools to determine what an asset is doing. In addition to support and resistance, there are several tools that can help you decide if an asset is a good option for range trading at any particular moment. A trading range occurs when a market moves consistently between two prices or levels for a definitive period of time. Like trend following, which can be used on any time frame, range trading can be seen in all time frames, from short-term five-minute charts to long-term daily and monthly charts.

Range trading vs trend trading

After it had moved so fast in a short period of time, the reversal could be equally swift towards the downside. Whenever the market makes a power move into resistance, you’ll have greater profit potential. If you’re looking to short the highs of the range, this is where you’ll take advantage of this phenomenon.

Before you hop into the fray, it’s a good idea to understand how to approach cityindex review to maximize your chance of success. These key strategies will help you use market indicators to make a profit. All financial markets find assets falling within support and resistance lines. With your range identified and your entry set up, you must not forget the final part of any effective range trading attempt. Risk management is always a crucial factor, no matter how you choose to trade, but it carries much more importance when you choose to range trade.

They show an asset’s average closing price over a certain period of time, like 50 days or 200 days. If the moving average is more flat, that means there is less volatility. If you’re seeing the moving average consistently going up or down, that indicates the price is trending. Of course, assets don’t always stay within their support and resistance lines, and that can give you information about an incoming trend.

Trading a range breakout

With this strategy, the trader is looking to make profits by entering and exiting the trade near to the support or resistance levels. The expectation is that the price of a currency pair will eventually revert to the other side of the established range. Indicators and Candlestick patterns are useful tools for identifying the best times to enter these trades. Nonetheless, range trading strategies are not ideal for all market conditions or even in all ranging markets.

In this article, we will look at some of the key options you have during a ranging market. One way to determine if the market is ranging is to use the same ADX as discussed in the ADX lesson. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Discover the range of markets and learn how they work – with IG Academy’s online course.

The idea is to capitalize on the price’s tendency to return to the mean. The average individual may want to consider other factors when making investment decisions, as the trading range does not guarantee a security will stay within that range. On the flip side, it’s possible for a stock to exceed its trading range, too.

Trading range occurs when price actions consistently bounce between established highs and lows for a certain period. The risk, however, is that the security might not stay within this range. You might purchase a stock at $11 per share when it’s near its monthly trading range low of $10, thinking it will bounce back toward its high.